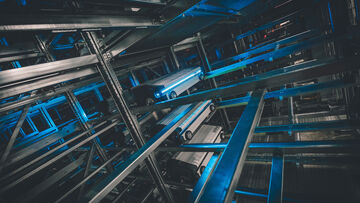

Logistics seems so simple – just goods in, goods out. For us there is so much more to it.

-

Supply Chain

ManagementWe develop holistic, innovative supply chain solutions, optimize your logistics processes and exploit untapped potential to take your business to the next level. Learn more

Supply Chain

Management -

Logistics &

FulfillmentWe design effective and scalable solutions for your B2C and B2B sales channels and organize the entire process from order taking to delivery. Learn more

Logistics &

Fulfillment -

Transport

ManagementFrom order to delivery: we find the right delivery solutions for your goods and design integrated transport networks. Learn more

Transport

Management -

Digital

SolutionsThrough our industry expertise and use of state-of-the-art technologies, we ensure that your clients enjoy a first-class shopping experience. Learn more

Digital

Solutions